Applying Vendia Share smart contracts

Overview

Vendia Share enables companies to rapidly build applications that securely share data across departments, companies, and clouds. When participants create a new Universal Application (or "Uni" for short) using Vendia Share, sharing data is usually their first motivation. Once participants have access to a real-time, shared source of truth, acting on the data is almost always their next focus area.

There are many ways to act on the data using Vendia Share: auto-generated GraphQL APIs, event-driven inbound and outbound integrations, and, more recently, the introduction of smart contracts.

Smart contracts allow participants to take action on data stored in a Uni in a predefined way, one that is versioned and ledgered for the improved transparency of all participants. This allows predefined and versioned functions to be created by a single participant for the benefit of one or more participants. Further, the ledgered nature of smart contracts provides an added level of transparency and auditability that the "off-chain" data processing approaches do not. For example, smart contract invocations include a reference to the exact input, parameters, and source code used to produce an output.

Smart contracts can be used for a variety of purposes, including:

- Data validation - Making sure data is valid prior to its use by other participants

- Data computation - Calculating new data values using data shared by other participants

- Data enrichment - Enhancing data with additional information provided from an external system

In a recently published smart contracts feature example, we explore a set of smart contracts that includes a full-featured example of each smart contract type listed above.

In this post, we'll look at the data validation smart contract from the feature example. See the feature example itself for a complete step-by-step guide through all three smart contracts.

Example: Data validation smart contract

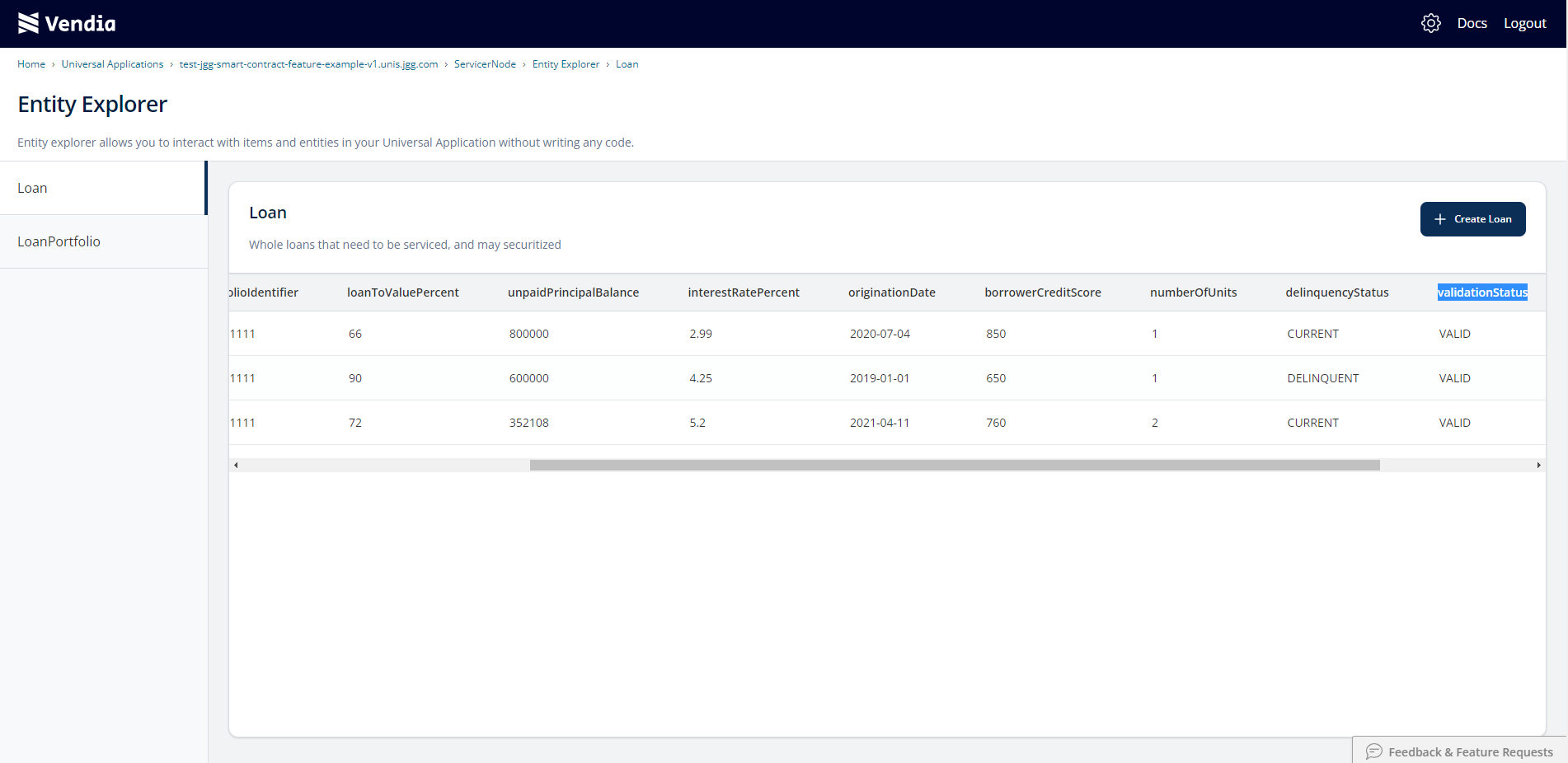

The feature example explores a Uni with two participants: a Lender and a Servicer, working together to improve the home mortgage process. The Lender creates new home loans on the Uni. The Servicer manages a portfolio of home loans on the Uni. Both participants make use of smart contracts to automate their interactions and increase their operational transparency.

After the Lender and the Servicer create a Uni to share home loan information with each other, they want to maintain a high level of data quality. Specifically, the Lender wants to ensure the Servicer is only able to view and act on validated loans.

The high-level interaction process looks like this:

- The Lender adds loans to the Uni, initially loans with a

validationStatusof aPENDING - The Lender executes a smart contract to validate each loan, resulting in an updated

validationStatusbased on the validation resultVALIDif the loan meets all validity checksINVALIDif the loan did not meet one or more validity checksERRORif the validity checks weren't fully performed

- The Servicer views only those loans whose

validationStatuswas set toVALID, thanks to access control list (ACL) updates applied only to successfully validated loans

While the validation logic used in this example is simple, the power of implementing logic that automatically affects data access is powerful. Dynamic data access updates allow a data owners to load and validate data prior to sharing with other participants, which in turn allows all Uni participants to increase productivity and eliminate time spent viewing or processing invalid or outdated data.

Defining the validation logic

The schema for the Uni provides basic data validation based on the schema definition. For example, loanIdentifier must be a 16-digit value, originationDate must be a valid date, and originalInterestRate must be a number between 0 and 100. Vendia Share's GraphQL API implementation will reject inputs that are invalid with respect to the Uni's schema. While basic data validations are necessary, they do not address the validation of business rules that cannot be expressed through a pre-defined format or regular expression.

The Lender can use a smart contract to ensure more in-depth data validation occurs prior to the Servicer making use of the data.

Let's assume the Lender wants to perform two additional validations on every new loan added to the Uni.

- Origination Date Validation - Ensuring

originationDateis not a future date (i.e. a Loan can't exist if it hasn't yet been created) - Original Unpaid Principal Balance Validation - Assessing

originalUnpaidPrincipalBalancevalidity based on theborrowerCreditScore(i.e. using a simple formula for this example to confirm theoriginalUnpaidPrincipalBalanceis appropriate given theborrowerCreditScore)

Neither of these in-depth validations are feasible through the schema definition itself. Both require dynamic validation using the data provided as part of a new Loan.

Elements of a smart contract

The validation smart contract takes three important pieces of information as part of its definition: an inputQuery, an outputMutation, and the AWS Lambda function that executes the validation logic defined in the previous section.

The inputQuery retrieves information from the Uni and provides it as input during smart contract invocation. The validation smart contract uses an inputQuery that retrieves the necessary fields for the loan to be validated, using a parameterized loanIdentifier that will be provided during smart contract invocation.

query ValidationInputQuery($loanIdentifier: String!) {

list_LoanItems(filter: {

loanIdentifier: { eq: $loanIdentifier }

}) {

_LoanItems {

... on Self_Loan {

_id

loanIdentifier

borrowerCreditScore

unpaidPrincipalBalance

originationDate

}

}

}

}

The AWS Lambda function uses the data provided by the inputQuery, applies the data validation logic, and returns an object containing the fields required by the outputMutation.

/**

* Performs a set of validations against a loan provided as part of the event input.

*

* @param event that contains a loan to be validated, among other fields

* @returns Promise of an object that contains the validation results

and ACL modifications, as expected by the associated smart contract's outputMutation

*/

exports.handler = async (event) => {

let loan = {}

let validationStatus

let acls

try {

console.log("Event is", event)

loan = event.queryResult.list_LoanItems._LoanItems[0]

console.log("Loan is", loan)

let isValid = isValidOrigination(loan.originationDate) &&

isValidLoanAmount(loan.unpaidPrincipalBalance, loan.borrowerCreditScore)

console.log("Validation function determined the loan" + (isValid ? " IS " : " IS NOT ") + "valid");

if (isValid) {

validationStatus = "VALID"

acls = [{

principal: {

nodes: "LenderNode"

},

operations: ["ALL", "UPDATE_ACL"]

},

{

principal: {

nodes: "ServicerNode"

},

operations: ["READ"]

}

]

} else {

validationStatus = "INVALID"

acls = [{

principal: {

nodes: "LenderNode"

},

operations: ["ALL", "UPDATE_ACL"]

}]

}

} catch (error) {

console.error("Unexpected exception during validation", error)

validationStatus = "ERROR"

acls = [{

principal: {

nodes: "LenderNode"

},

operations: ["ALL", "UPDATE_ACL"]

}]

} finally {

console.log("Returning " + validationStatus + " and " + acls + " for loan " + loan._id)

return {

id: loan._id,

validationStatus: validationStatus,

acl: acls

}

}

}

/**

* True if originationDate is prior to now, false otherwise

* @param originationDate of a loan

* @returns {boolean} true if origination date isn't in the future, false if it is

*/

function isValidOrigination(originationDate) {

return Date.parse(originationDate) < Date.now()

}

/**

* True if balance is less than or equal to borrower's credit score multiplied by 1000

* @param balance on the loan

* @param creditScore of the borrower

* @returns {boolean} true if credit score is sufficiently large for the balance provided

*/

function isValidLoanAmount(balance, creditScore) {

// A very simplistic check, which can easily be replaced by a more complex algorithm

const score = creditScore * 1000

return score >= balance

}

The outputMutation maps the return value from the AWS Lambda function to a predefined mutation that will result in data being written back to the Uni. The expected result of executing the validation smart contract is a change to a loan's validationStatus field and, only if validation was successful, a change to the loan's data access controls to allow the Servicer to see the (now-validated) loan information.

mutation ValidationOutputMutation(

$id: ID!

$validationStatus: Self_Loan_validationStatusEnum!

$acl: [Vendia_Acl_Input_!]

) {

update_Loan_async(

id: $id

input: { validationStatus: $validationStatus }

aclInput: { acl: $acl }

) {

error

}

}

For more information on how to create a data validation smart contract, please refer to the step-by-step guide in the feature example.

Invoking a smart contract

The data validation smart contract can be invoked programmatically or manually using the Vendia Share web application's Smart Contract view.

The feature example demonstrates programmatic execution using a set of provided scripts. For the rest of this post, we'll use the Vendia Share web application to make the invocation and results more visual.

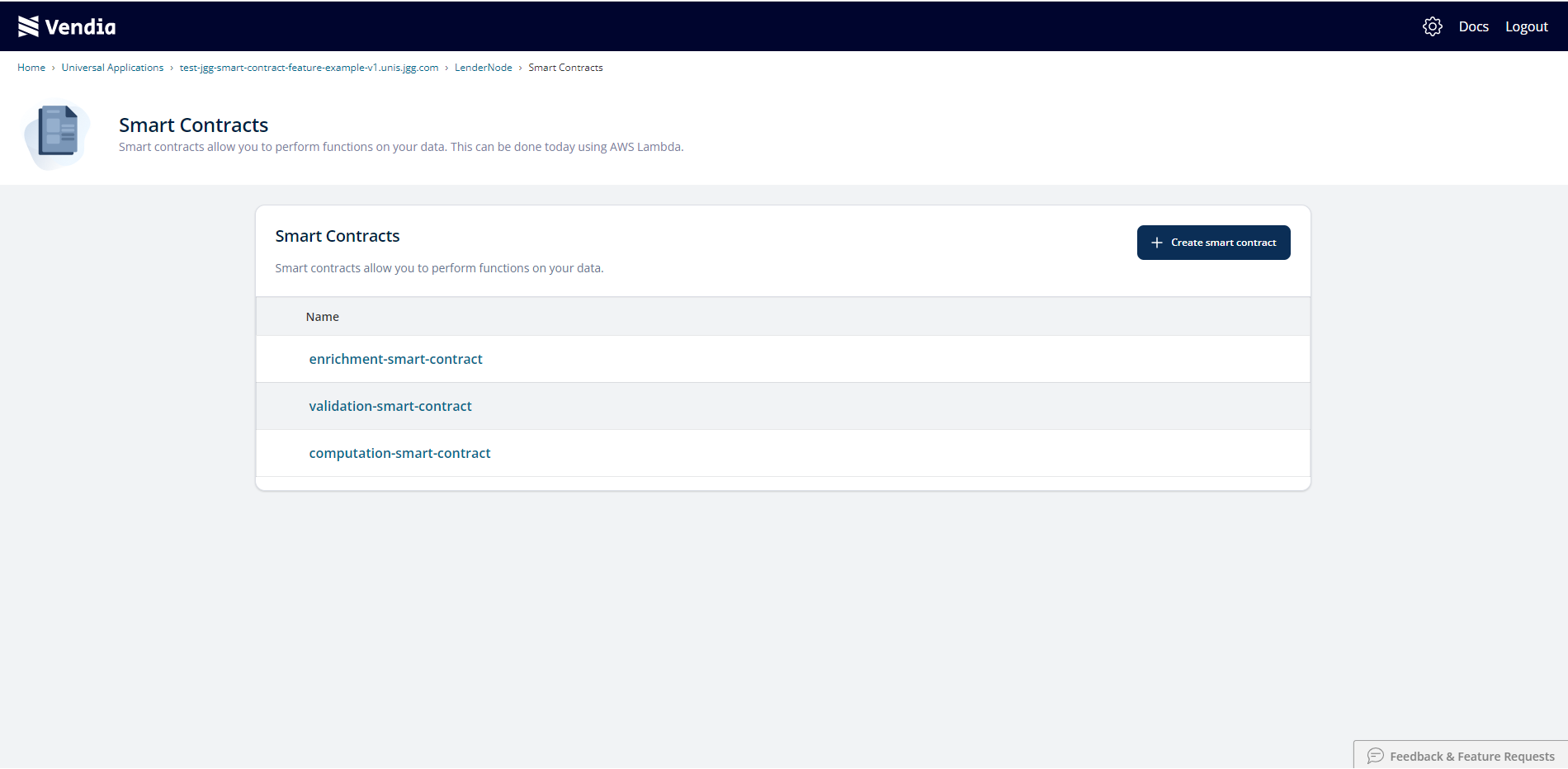

From the LenderNode of the Uni created in the feature example, click the Smart Contracts widget to get a listing of all available smart contracts.

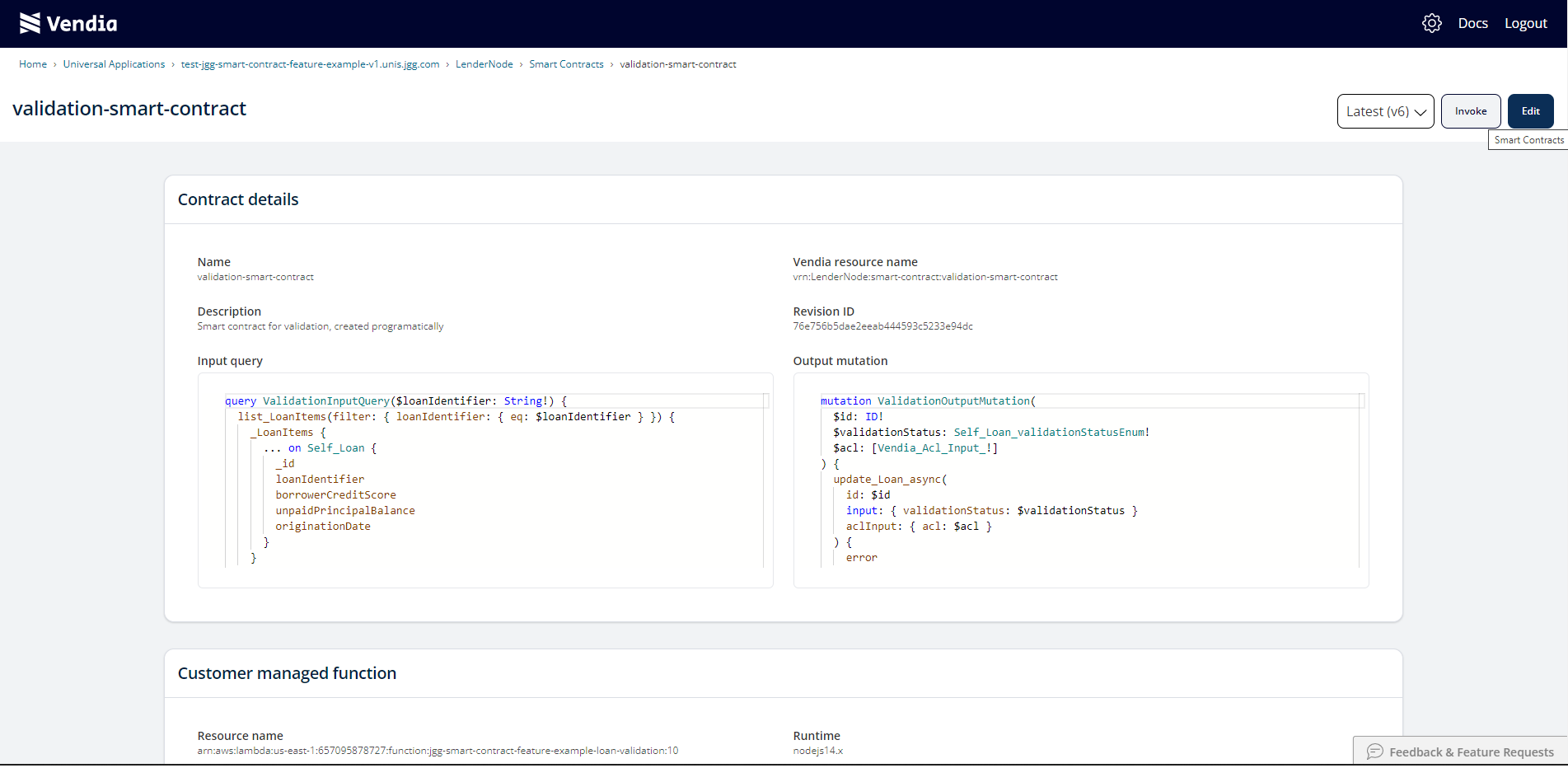

Select the validation-smart-contract to view its details, including the ability to manually invoke the smart contract. Next, click the Invoke button in the upper right to load the smart contract invocation modal window.

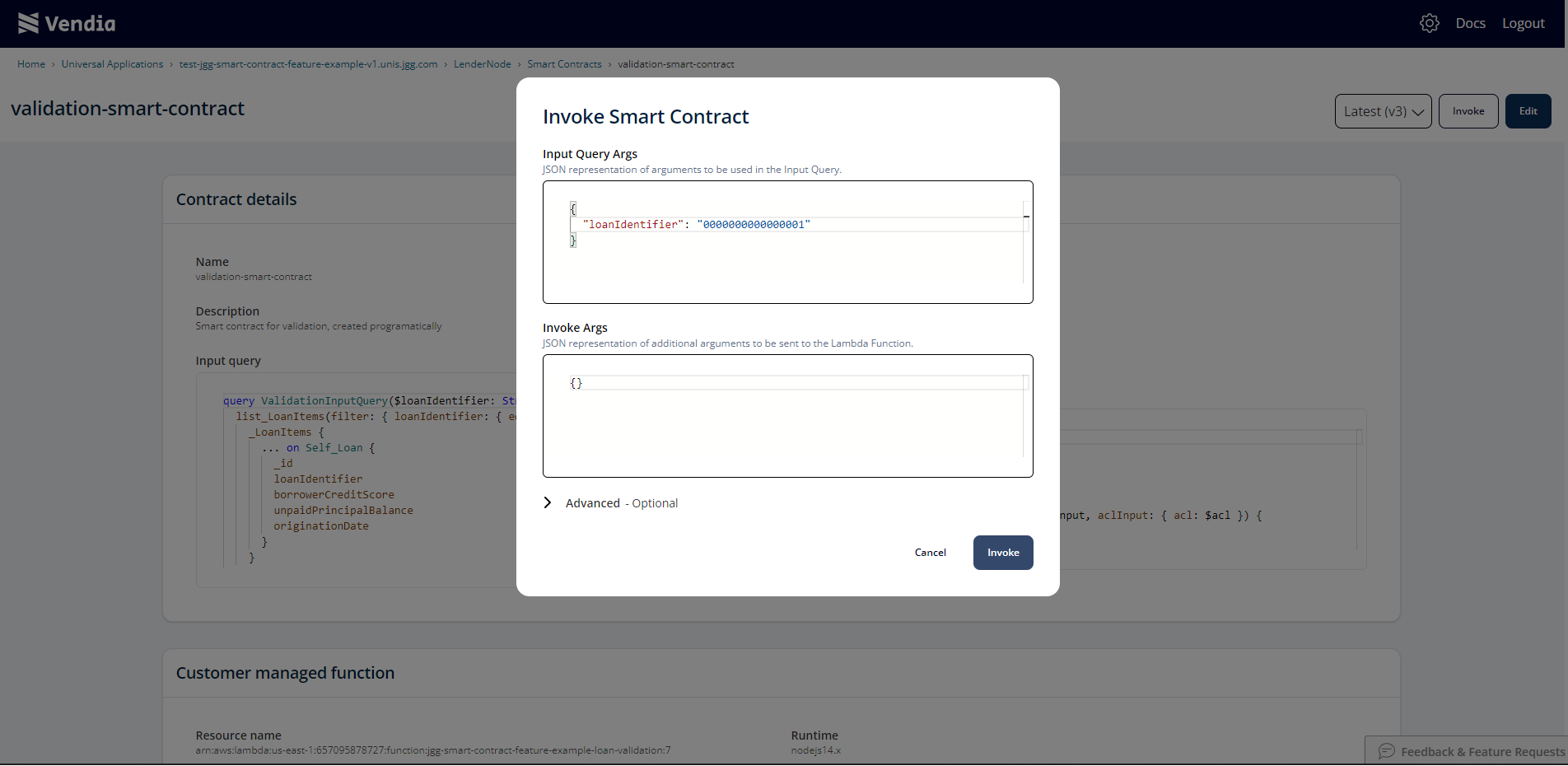

Then, provide a valid loanIdentifier. The loanIdentifier provided is the value that will be sent to the parameterized inputQuery defined in the previous section.

By clicking Invoke in the bottom right of the modal shown, the smart contract will be executed, obtaining loan data from the Uni using the inputQuery, providing that retrieved data to the AWS Lambda function so it can perform loan validation, and writing the validation result back to the Uni using the outputMutation.

The end result is a:

- Lender who is able to apply custom validation logic and ensure only validated loans are shared with other participants

- Servicer able to confidently process the loans it has access to, knowing they are valid

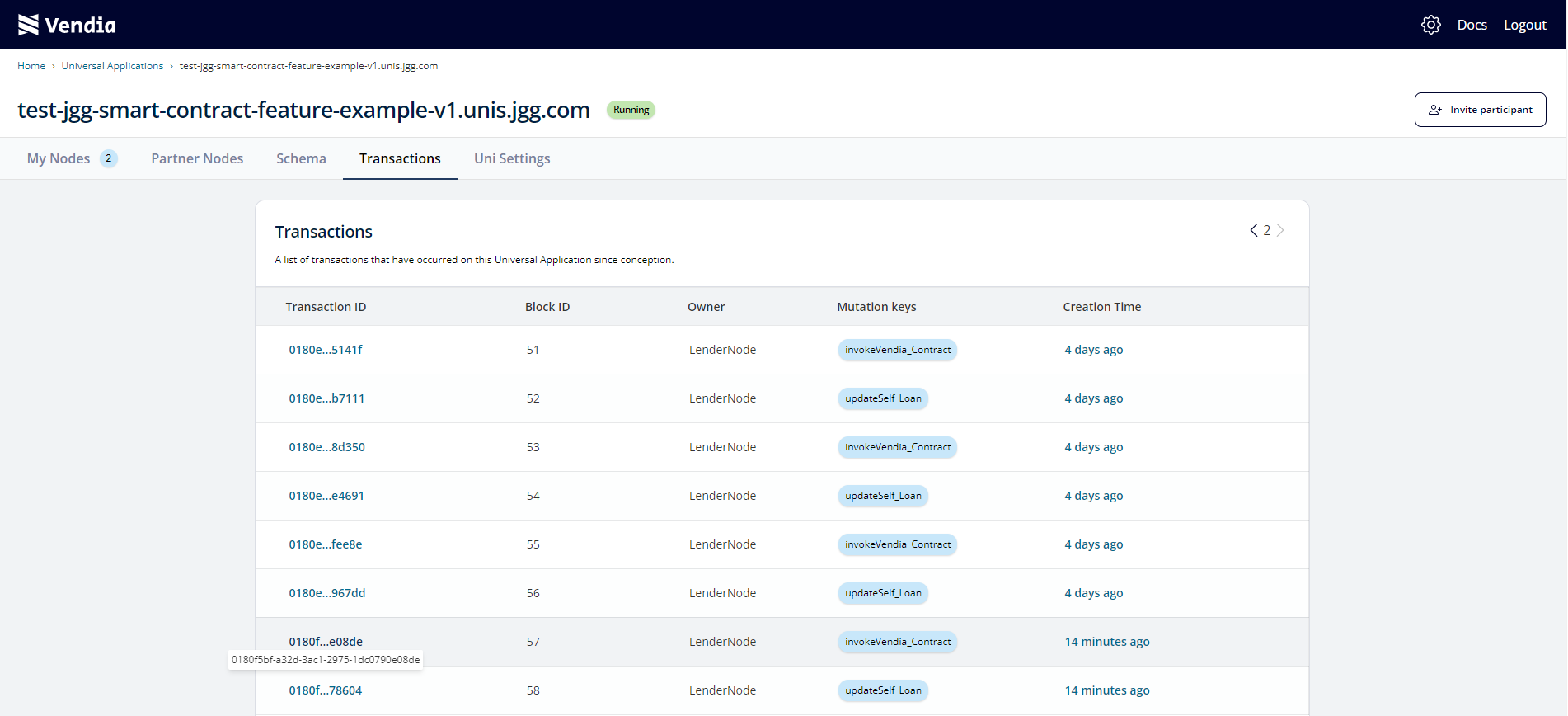

Unlike other methods of event-driven data processing using Vendia Share, smart contracts not only produce the desired results but they also leave an auditable history (invocation and results) in the ledger.

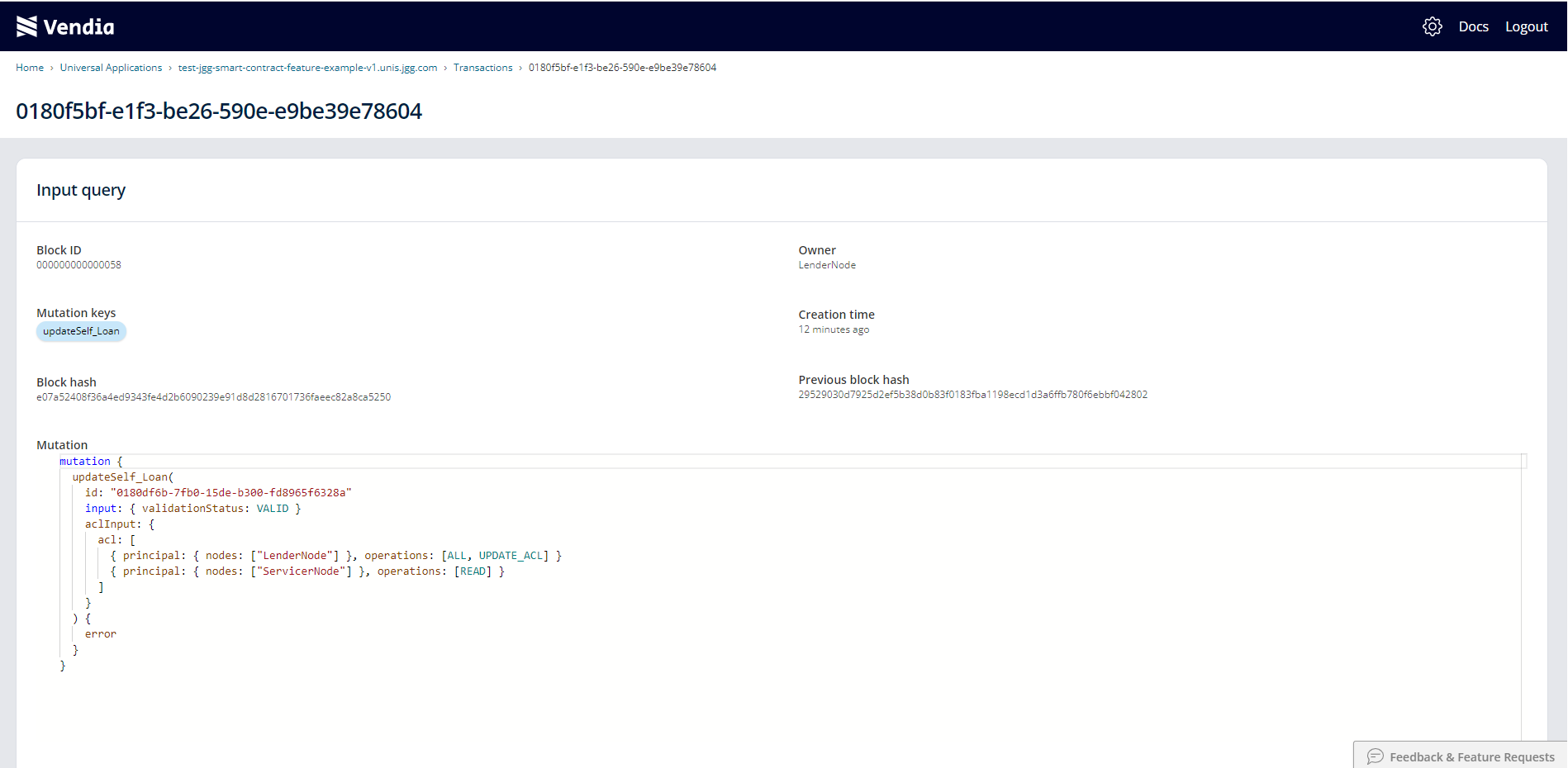

Selecting one of the ledger entries provides more detail about the ledgered transaction. For example, the output mutation generated by the validation smart contract can be seen in its entirety.

Conclusion

Smart contracts can be used for a variety of purposes, including data validation, computation, and enrichment. The recently published smart contract feature example provides a step-by-step guide to create and invoke a set of smart contracts, each demonstrating slightly different interaction patterns and smart contract composition approaches. Using smart contracts allows data and code to be shared and ledgered for real-time awareness and full transparency across a network of Uni participants.